How To Arbitrage Cryptocurrency

Cryptocurrency arbitrage is a type of trading that exploits differences in prices to make a profit. One method of crypto arbitrage is to buy a cryptocurrency on one exchange, then transfer it to another exchange where the currency is sold at a higher price.

Everything You Need to Know About Cryptocurrency Arbitrage

Cryptocurrency arbitrage is fundamentally no different than other asset types and in this article, i will show you how i was able to achieve a 1 % profit an hour with nothing more than a hundred bucks in cryptocurrency and a little programming knowledge.

How to arbitrage cryptocurrency. The arbitrage opportunity for any market is calculated by identifying the overlap between the highest bid prices and the lowest ask prices. This system makes it easy for you to track the prices of what you are interested in trading, with a number of different strategies ready to help you make a. An initial coin offering (ico) is the cryptocurrency industry’s equivalent to an initial public offering (ipo).

Arbitrage center for cryptocurrency,swaprol token. This leads us to the third benefit of arbitrage which is when it is the start of a particular crypto market, which results in less competition. Multitrader is cryptocurrency arbitrage trading platform.it monitors 21 cryptocurrency exchanges.

However, the prices of cryptocurrencies vary from one exchange to another. There are many different markets and exchanges for the wide variety of cryptocurrencies. Arbitrage is taking advantage of the price difference between identical assets but in two different markets.

Arbitrage ct is a truly new, unparalleled, instrumental trading tool for crypto currency, allowing you to trade on several exchanges for several pairs simultaneously! It is the notion that a profit can be made by merely buying and selling the same assets in different markets in order to take advantage of the price difference. Understanding arbitrage trading possibilities and opportunities in the crypto world.

The cryptocurrency is highly volatile, thereby associated with huge profits and losses, so crypto arbitrage trading could be proved as an opportunity to earn even from your small investments. It is constantly searching for arbitrage opportunities. The crypto market, as in the stock market, exhibit price imbalances across different cryptocurrency exchanges that can be an opportunity to gain profit from.

Cara trading arbitrage dalam bitcoin dan cryptoccurency. Cryptocurrency arbitrage is about leveraging prices to your advantage. Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets.

Any given asset (coin/token) will be offered at different prices across exchanges. When the bid price on one exchange is higher than the ask price on another exchange for a cryptocurrency, this is an arbitrage opportunity. Ada tiga metode arbitrage dalam trading cryptocurrency:

This market imperfection is essential in executing an arbitrage in which an astute trader with a trained eye can spot, exploit, Due to the market inefficiency and volatility, the arbitrage in cryptocurrency trading occurs more often compared to other financial markets. If an arbitrage opportunity arises that would require order amounts of 0.65201 btc on two markets, but one market only allows three decimal places, you won’t be able to submit those orders.

In a highly simplified example of how cryptocurrency arbitrage works, you would search for a specific coin that’s cheaper on exchange a than on exchange b. Crypto arbitrage or bitcoin arbitrage is the process of buying cryptocurrencies from one exchange at low prices and selling them in another exchange where the prices are high. What tools are available to help with cryptocurrency triangular arbitrage?

What are some of the challenges of arbitrage trading? Cryptocurrency live prices & arbitrage. It offers crypto coin arbitrage, also exchange based arbitrage, depending on user's selected percentage our crypto.

The first being the quick way to profit from a simple exchange with the second encompassing a wide range of options to exchange. If there is a difference in the price of one asset on different exchanges, a trader can profit from buying and selling it in different markets. Spreads usually only exist for a matter of seconds, but transferring between exchanges can take minutes.

Each crypto exchange has its value for specific cryptocurrencies, and this may be due to multiple reasons. It allows to trade on the arbitrage opportunities with the use of bots. Clear opportunities for arbitrage ( taking advantage of a price difference between exchanges ).

Arbitrage is the simultaneous buying and selling of an asset on different markets to profit from the price difference between those markets. There are a few problems with this method, however. Mencakup mendapatkan keuntungan dari perbedaan harga cryptocurrency yang terdaftar di dua exchange yang berbeda.

Crypto trading has been around for quite a few years now; These price differences commonly referred to as “arbitrage spreads”, can be used to buy a cryptocurrency at a lower price and then sell it at a higher price. Find out more about our product by reading our website to the end.

The idea of the arbitrage lies in benefiting from market inefficiencies. In a highly simplified example of how cryptocurrency arbitrage works, you would search for a specific coin that’s cheaper on exchange a than on exchange b. Cryptocurrency arbitrage is merely an extension of arbitrage in more traditional markets and environments.

Cryptocurrency arbitrage allows you to execute your trading transactions manually, while also providing a thorough monitoring of the current situation of the market, while also ensuring that the price differences are at returnable level. Crypto arbitrage trading is simply the simultaneous buying and selling of the crypto coins in two markets and to gain from the difference in prices. The primary challenges of the traditional arbitrage in cryptocurrency trading are the reaction, the need to quickly transfer funds from one exchange.

Users can do it manually which take time while use of automated cryptocurrency arbitrage bot platforms are the process more efficient and profitable.

CryptoCurrency Arbitrage Trading Software YouTube

CryptoCurrency Arbitrage Trading Software YouTube

How To Get Free CryptoCurrency using Arbitrage 2018 VERY

How To Get Free CryptoCurrency using Arbitrage 2018 VERY

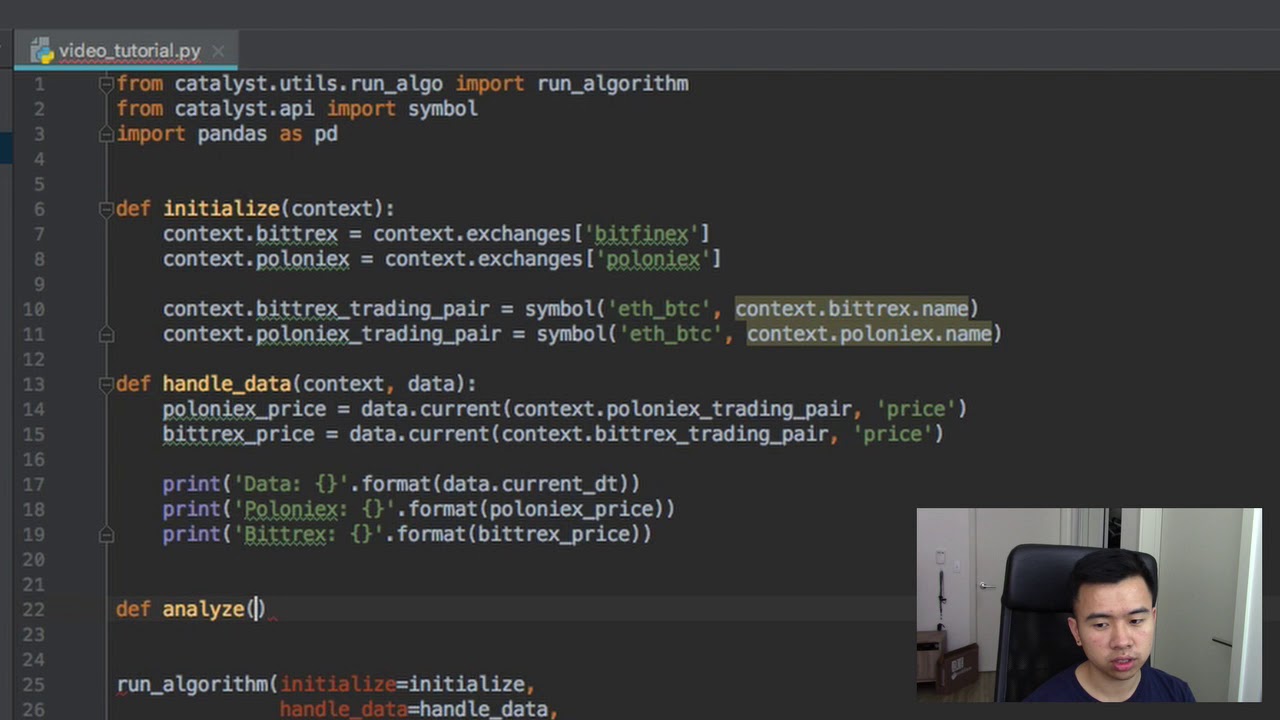

Building a cryptocurrency arbitrage bot Part 1 Basics

Building a cryptocurrency arbitrage bot Part 1 Basics

New Bitcoin Cryptocurrency Arbitrage Investment Pool

New Bitcoin Cryptocurrency Arbitrage Investment Pool

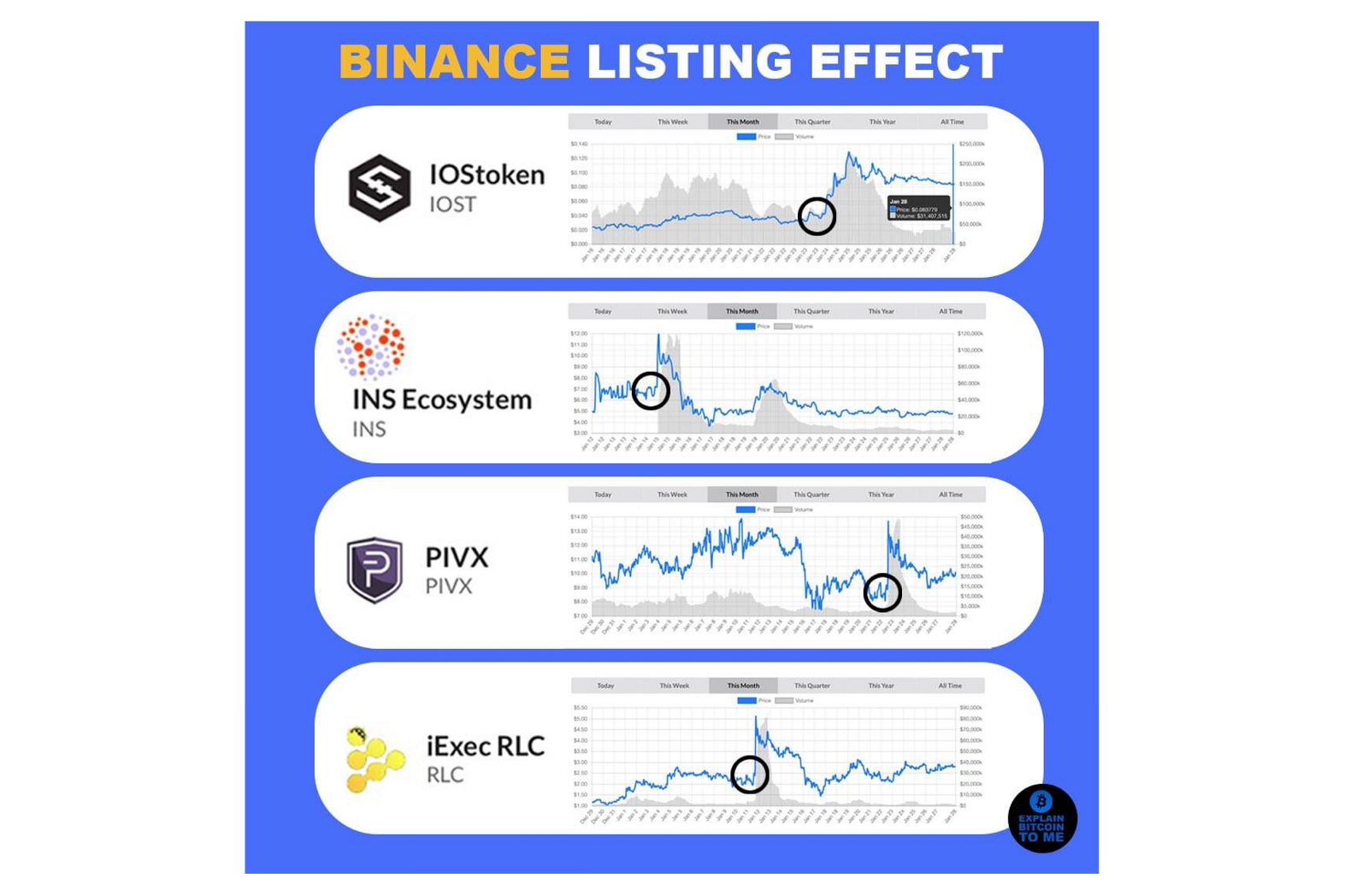

Cryptocurrency Arbitrage Strategies How To Reap Maximum

Cryptocurrency Arbitrage Strategies How To Reap Maximum

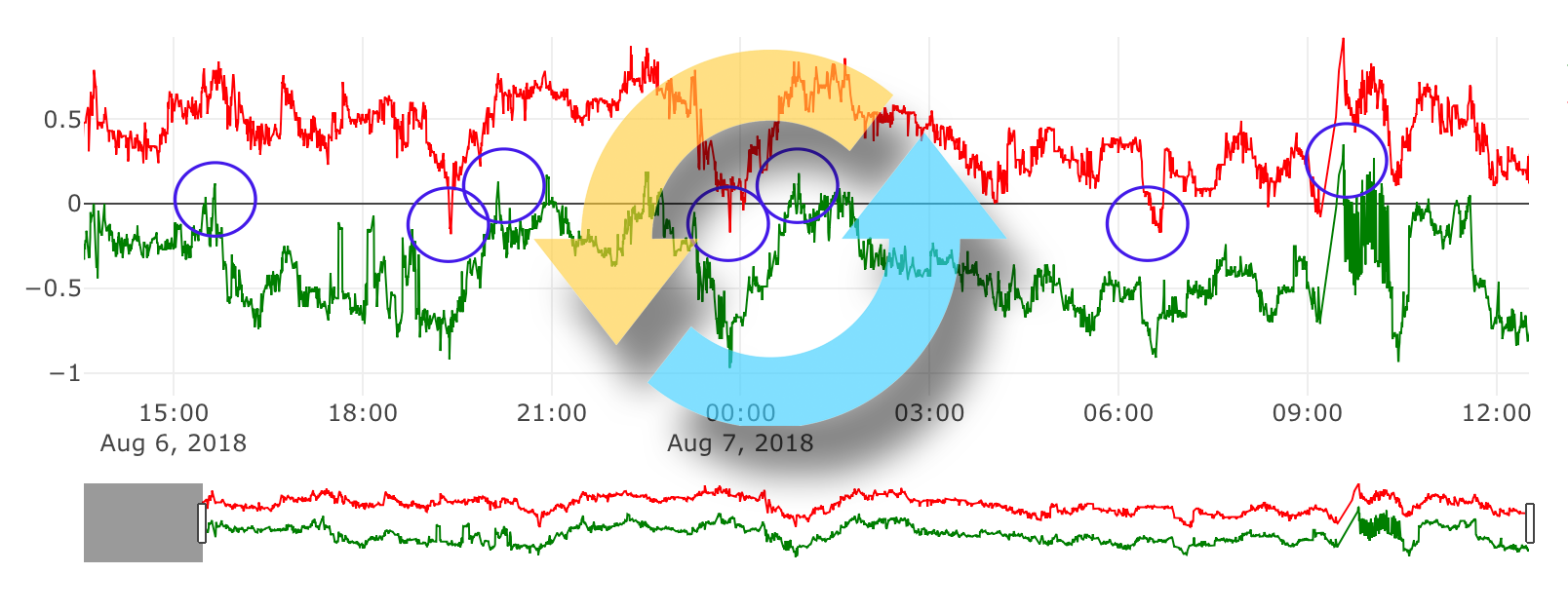

Arbitrage in the Cryptocurrency Market Hacker Noon

Arbitrage in the Cryptocurrency Market Hacker Noon

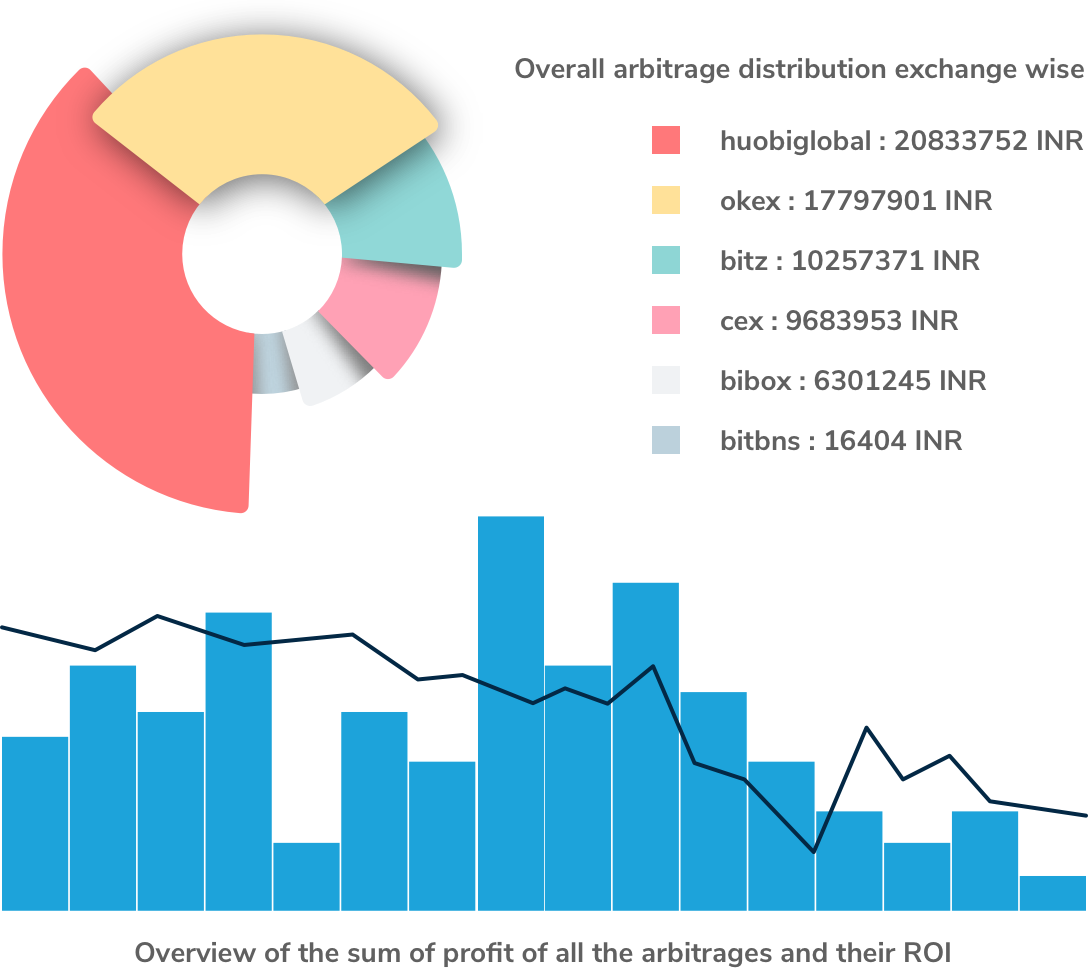

Visualizing Arbitrage Data 1 Arbitrage Cryptocurrency

Visualizing Arbitrage Data 1 Arbitrage Cryptocurrency

Cryptocurrency Arbitrage All You Need to Know. Part 2

Cryptocurrency Arbitrage All You Need to Know. Part 2

Historical Analysis Cryptocurrency Arbitrage KoinKnight

Historical Analysis Cryptocurrency Arbitrage KoinKnight

Cryptocurrency Arbitrage All You Need to Know. Part 1

Cryptocurrency Arbitrage All You Need to Know. Part 1

CryptoURANUS Economics Arbitrage Defined in CryptoCurrency

CryptoURANUS Economics Arbitrage Defined in CryptoCurrency

Make Money Bitcoin Arbitrage How To Get Free Btc On Telegram

Make Money Bitcoin Arbitrage How To Get Free Btc On Telegram

A Super Simple Cryptocurrency Arbitrage Spreadsheet for

A Super Simple Cryptocurrency Arbitrage Spreadsheet for

Crypto Arbitrage Trading In 2020 How to Arbitrage

Crypto Arbitrage Trading In 2020 How to Arbitrage

Cryptocurrency Arbitrage Guide All You Need To Know

Cryptocurrency Arbitrage Guide All You Need To Know

Arbismart Trusted Transparent Arbitrage Trading EU

Arbismart Trusted Transparent Arbitrage Trading EU

What is Cryptocurrency Triangular Arbitrage? Crypto

What is Cryptocurrency Triangular Arbitrage? Crypto

Cryptocurrency Arbitrage Calculator great website! — Steemkr

Cryptocurrency Arbitrage Calculator great website! — Steemkr

An Introduction to Cryptocurrency Arbitrage Trading

An Introduction to Cryptocurrency Arbitrage Trading

Comments

Post a Comment